In the rapidly evolving world of technology, cryptocurrencies have become a cornerstone of innovation, with Bitcoin (BTC) as the most recognized digital asset. The conversion of USD to BTC has become increasingly common, reflecting the growing acceptance of Bitcoin in mainstream financial systems. Understanding how technology plays a crucial role in this conversion process and its broader implications for the future of finance is essential for anyone navigating the cryptocurrency space today.

The Role of Technology in USD to BTC Conversion

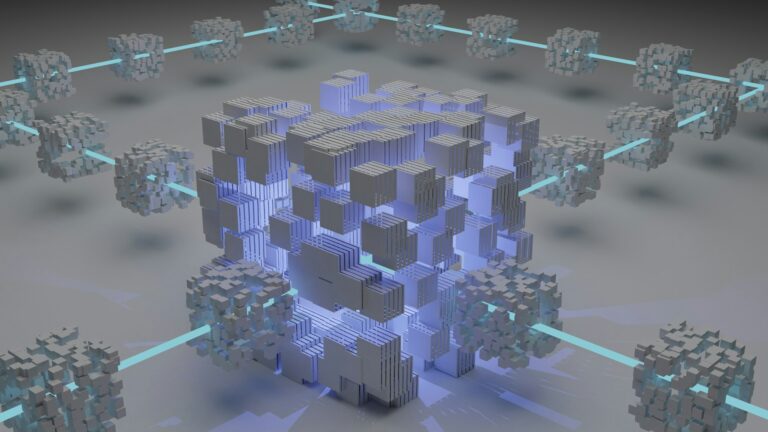

Technology has revolutionized the way currencies are exchanged, and nowhere is this more evident than in the USD to BTC conversion process. Blockchain technology, digital wallets, and secure cryptocurrency exchanges facilitate the transformation of fiat currencies like the US dollar into digital assets such as Bitcoin.

- Blockchain Technology: The core of Bitcoin’s operation lies in blockchain, a decentralized and distributed ledger technology. Each transaction from USD to BTC is recorded in a blockchain, ensuring transparency, security, and immutability. Blockchain technology enables trustless transactions, meaning two parties can exchange value without an intermediary like a bank. This technological breakthrough has transformed Bitcoin into a viable alternative to traditional currency systems.

- Digital Wallets: The digital wallet is an essential technology enabling the conversion of USD to BTC. A digital wallet is a software application that allows users to store, send, and receive Bitcoin. When converting USD to BTC, the purchased BTC is stored in these digital wallets protected by cryptographic keys. These wallets range from hot wallets (connected to the internet) to cold wallets (offline storage) for enhanced security. Without digital wallets, converting and securely storing BTC would be challenging.

- Cryptocurrency Exchanges: Cryptocurrency exchanges such as Coinbase, Binance, and Kraken are pivotal in facilitating USD-to-BTC conversions. These exchanges provide platforms where users can trade USD for Bitcoin, offering features such as real-time price tracking, charting tools, and automated trading bots. Advancements in trading technology have simplified the process, making it accessible even to those without a technical background. Additionally, decentralized exchanges (DEXs) have emerged, offering peer-to-peer trading without intermediaries and giving users more control over their funds.

The USD to BTC Conversion Process

Converting USD to BTC is straightforward yet underpinned by advanced technology. It typically involves a few key steps:

- Sign Up for a Cryptocurrency Exchange: The first step is to sign up for a reputable cryptocurrency exchange. Exchanges act as intermediaries where buyers and sellers of BTC meet. These platforms usually require users to verify their identity before trading to comply with Know Your Customer (KYC) regulations.

- Deposit USD: Once registered, users can deposit USD into their accounts through different methods such as bank transfers, debit cards, or even PayPal. The speed and cost of depositing funds may vary depending on the method chosen, but this step marks the entry of fiat currency into the cryptocurrency ecosystem.

- Place an Order for BTC: After the USD is deposited, the next step is to place an order to buy BTC. Exchanges offer different orders, including market orders and limit orders (buying at a specified price). Advanced traders may use other order types like stop-loss or take-profit to manage risk.

- Conversion to BTC: Once the order is executed, the USD is converted to BTC at the exchange rate, and the Bitcoin is transferred to the user’s digital wallet. The speed of this process depends on factors like network congestion and the transaction method, with some transactions completing in minutes and others taking longer.

Why Convert USD to BTC?

The motivation to convert USD to BTC stems from several factors that highlight Bitcoin’s growing importance in today’s financial landscape.

- Inflation Hedge: One of the reasons why people convert USD to BTC is to protect against inflation. As central banks worldwide print more money, fiat currencies like the US dollar can lose value over time. With its fixed supply of 21 million coins, Bitcoin is often foreseen as a hedge against inflation, maintaining its value during economic uncertainty.

- Decentralization: Bitcoin operates on a decentralized network, which means it is free from control or manipulation of the government. For those seeking financial sovereignty, converting USD to BTC offers a way to participate in a global financial system that operates independently of traditional banking institutions.

- Investment Opportunities: Many investors see the volatility of Bitcoin as an opportunity. While the price of BTC can fluctuate significantly, these price swings create opportunities for profit through trading and long-term investment. Bitcoin’s performance over the past decade has led many to view it as “digital gold,” a store of value that can be appreciated over time.

- Global Transactions: Bitcoin allows for borderless transactions, making it an attractive option for international trade and remittances. Converting USD to BTC enables individuals and businesses to send payments across borders quickly and with lower fees than traditional banking systems, particularly in regions with limited access to banking.

Challenges and Risks in USD to BTC Conversion

While converting USD to BTC offers numerous advantages, there are also challenges and risks. The cryptocurrency market is highly volatile, and the price of Bitcoin can swing dramatically within short periods. This volatility can lead to various substantial losses if not managed properly.

Moreover, security remains a significant concern. Despite technological advances, digital wallets and exchanges are still vulnerable to hacking. To protect their assets, users must take precautions such as using hardware wallets for cold storage, enabling two-factor authentication, and avoiding phishing scams.

Regulation is another area of uncertainty. Governments worldwide are grappling with how to regulate Bitcoin and other cryptocurrencies. Regulation changes could impact the ease with which people can convert USD to BTC or even hold cryptocurrencies.

The Future of USD to BTC Conversion

As technology evolves, the future of USD to BTC conversion looks promising. Advancements in blockchain scalability, improved wallet security, and the growth of decentralized finance (DeFi) make converting and using Bitcoin even more seamless. Moreover, as Bitcoin gains further adoption by institutions, its liquidity and stability may improve, reducing some of the risks associated with its volatility.

Conclusion

In conclusion, the technology underlying the USD to BTC conversion transforms how people interact with money, offering a decentralized, secure, and potentially profitable alternative to traditional fiat currencies. While challenges remain, Bitcoin’s increasing integration into the global financial system suggests that its role as a digital asset is here to stay.