Probability models shape just about every debate in crypto and digital markets these days. Anytime prices swing sharply, there’s someone referencing a mathematical tool, maybe to justify a risky bet, maybe to cool off nerves. Researchers, traders, and coders all lean on these models, hoping to turn chaos into something they can weigh and act on. Some of this math comes from old-school finance, but plenty is borrowed from machine learning or built from scratch. It’s never pure theory for long. Every model, no matter how complex, gets pushed and pulled by the hunt for real-world utility. These days, you’ll see a mishmash: classic time-series analytics, fuzzy heuristics, and forecasting tricks drawn from the logic running online slots.

Classic statistical and machine learning models in crypto markets

GARCH volatility models, plain, EGARCH, GJR-GARCH, still dominate time-series analysis for crypto. Which one gets the job depends on the quirks in the latest Bitcoin or Ethereum data. A University of Latvia study from 2024 points out that nearly every paper on crypto price volatility features these models. Then there are HAR and HAR-RV models, which tease out the bumpy realized volatility unique to digital assets. Sometimes, ARFIMA models show up, handy for long, stubborn periods of calm or mania. Most researchers don’t stop at just one approach. Instead, they stack models, building ensembles that spit out entire probability ranges rather than pinning hope on a single forecast. The same ensemble logic pops up in online slots prediction; multiple models joined forces mean a tighter grip on outcomes. For traders, all this does more than look good in a paper: model output feeds straight into how much risk to take, when to hedge, and how to set the rules for automated trades.

Probabilistic forecasting frameworks and ensemble approaches

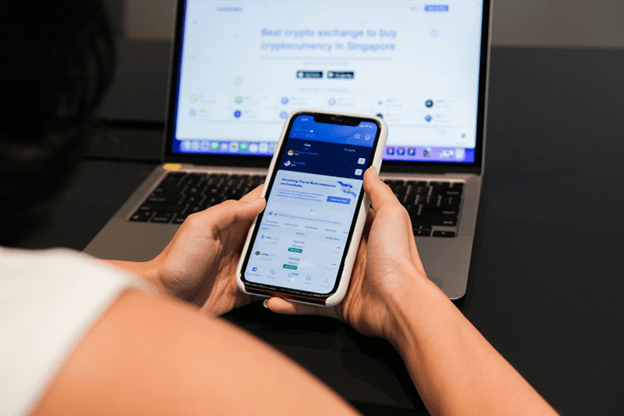

When nothing feels stable, forecasting morphs. Rather than settle for a single number, modelers look for the full spectrum, a probability distribution of where things might land. Techniques like Quantile Regression Forests and Quantile Estimation (by simulating how much predictions miss) translate crude model output into fine-grained quantiles, sometimes slicing the future into 99 pieces. These aren’t just fancy statistics. They mirror online slots prediction, where choices hinge on knowing the entire spread of possible outcomes. Assembling teams of models, classic statistics, neural nets, maybe a GARCH in the mix, and then fusing their predictions with a so-called meta-learner, gives a broader, more robust view. Metrics like the Winkler or CRPS scores check if these probability distributions actually hold up. Evidence in a 2024 arXiv preprint backs the claim: full distribution forecasts enable more measured decisions when volatility goes haywire. Output lands in everything from hedging routines to Crypto Prices Today how much margin someone needs to post.

Binary survival modelling for exchanges and heuristic probability in trading

Modeling isn’t just about prices. Exchange closures, which used to be mere gossip, are now run through classification algorithms: random forests, CatBoost, and others. That’s according to new research out of the Munich Personal RePEc Archive. Here, “Will this exchange disappear?” becomes a cold, hard binary question. To gain sharper odds, forecasters use methods like Beta Linear Pool or Beta Mixture Combination, blending various models into one probability number, much like banks have done for years with credit risk. Meanwhile, the messier side of trading leans on heuristics. Analysts, sometimes citing their own “rate” or a favorite technical signal, compress complex math into a language everyone on a trading desk understands. It might sound casual, but those “60% rate” claims mask underlying statistics as real as anything in a journal.

Market-wide probabilistic viewpoints and the role of stochastic modelling

Talk of randomness isn’t idle in crypto. The language of stochasticity, random walk, martingale, is everywhere. Bitcoin sometimes behaves almost predictably random, at least in the short term. That’s what a 2023 National Library of Medicine write-up found. Still, there’s a hurdle. Forecasts built on time-series data risk peeking ahead or reading too much into old patterns, so researchers counter this with strict out-of-sample tests. In the end, crypto predictions are always tangled with time and probability. While the jargon comes from econometrics, the focus on full probability curves and ruthless validation marks crypto out from the markets that came before.

Conclusion

Probability models are embedded in every corner of crypto’s universe. They steer predictions, help exchanges gauge their future, and shape the way traders act under pressure. Still, those numbers need caution: volatility makes even the best models wobble. Whether in finance or gaming, what matters is using probabilities wisely and being upfront about what they mean. Models clarify; they never guarantee. Keeping that in mind is what keeps traders’ bets and markets intact.